How to Increase Customer Lifetime Value

Acquiring new customers and signing deals give businesses a dopamine hit like no other. Companies repeat the famous line, “Always be closing,” from the Pulitzer Prize-winning play (and film of the same name) Glengarry Glen Ross to motivate sales teams, with reps awarded fat commissions and flashy bonuses, like trips to Maui or Antigua, for landing big accounts or exceeding sales quotas.

Well and good, but fixating on new customers overlooks a more cost-effective path to growing revenue: increasing customer lifetime value (CLTV). The longer an organization keeps its customers, the greater their value to the business over time.

Indeed, according to Bain & Co., boosting customer retention by just 5% can lead to profit gains of between 25% and 95%. Retaining existing customers is also cheaper; acquiring new ones costs five to 25 times more depending on which study you look at. Plus, the probability of selling to an existing customer can be up to 14 times higher than selling to a new prospect, according to Marketing Metrics.

Such numbers offer a strong argument for raising customer lifetime value — reason enough to look more closely at what exactly CLTV is, tactics for increasing it, and what a higher CLTV can do for your business beyond boosting revenue.

What is customer lifetime value?

| Customer lifetime value (CLTV) is a metric that measures the total amount that an individual will spend on your goods or services while they remain a customer. |

The acronyms for it vary — you’ll sometimes see it referred to as CLV or LTV — as do the formulas organizations use to measure their CLTV, so let’s examine why it can be a struggle to calculate and review the solution that’s turning heads.

Calculating customer lifetime value

Look around the web and you’ll find numerous articles that tell you to use this or that equation to calculate CLTV. The formulas will reference average order value (AOV), average purchase frequency (APF), and average customer lifespan (ACL) – tidy abbreviations with thorough explanations that don’t address the elephant in the room: that the data behind them sprawls messily across multiple data stacks.

Organizations today collect massive amounts of data from various sources (e.g., loyalty programs, order management systems, call centers) and different types of transactions (e.g., online, offline, those driven by sales teams), but unless you can link data from disparate channels to the same physical person or organization, you won’t arrive at an accurate CLTV. When data is siloed, what looks like a low-value customer in one silo may actually be among the most valuable when all the silos are combined into a unified customer view.

So, don’t get disheartened or distracted by complex CLTV calculations. Instead, focus on the critical first step of combining your data into a single location.

Fortunately, there are customer data platforms (CDPs) that do just that. Good ones will incorporate identity resolution as well as machine learning that ensure organizations can easily discover not just their actual CLTV, but their predicted CLTV as well. And, when those have been calculated, CDPs can help improve the numbers by facilitating better segmentation of customer groupings and more personalized outreach.

But CDPs are just one tool among many approaches and technologies that can juice your CLTV. What else is out there?

Tips for increasing customer lifetime value

Before we dive into how you can increase your average CLTV, know that it isn’t as hard as it may seem. You have to raise your average order value (AOV) or average purchase frequency (APF), which is all about enticing existing customers to buy more from you and more often. That means thinking about what might compel them to do so. Reflect on what works on you as a buyer and consider the following tactics:

1. Ensure a frictionless shopping experience

Retail giant Amazon is a sterling example of seamless shopping. A Prime membership gets you free shipping, and you click one button to complete your order. You can even use the company’s voice assistant Alexa to make your purchase. No sticker shock from high shipping costs, no form after form to fill out, no baffling navigation.

Mimic Amazon’s success and invest in your user experience (UX). At what point in the customer journey do prospects and customers get hung up? Is there an acceptable sale amount for which you’re willing to pay shipping, thereby eliminating the cost for the buyer? Examine the customer journey you offer and see where you can make improvements.

2. Listen to audiences

Studying pain points in the customer experience (CX) you serve may be done through tools like Google Analytics and others that monitor online sentiments, but you can also go directly to the source. Conduct focus groups with participants who match your target audience or customer personas (or invite existing customers). You could also email surveys or present them on social media, where you can post polls that ask about preferences: skinny jeans or flares, vanilla ice cream or rocky road, trail running or the gym? You get the picture.

Collect the responses in a single location, evaluate them, and share the results across teams. Doing so will align departments and guide a uniform plan of action that demonstrates how the organization listens to its audiences and acts on feedback. That responsiveness builds trust and relationships, promoting loyalty.

3. Share your product roadmap

This recommendation builds on the previous one because what you include in your product roadmap — be it new features in a mobile app or the introduction of a sustainable denim line — will hopefully incorporate input from prospective and existing customers. Seeing their needs recognized in your plans only builds trust.

Sharing specific timelines is ill-advised, however. Miss a deadline and you risk disappointing your audiences. It’s best to stick to estimates.

4. Underscore your value with helpful content

Too often, communications to customers revolve around sales (again with that “Always be closing” mindset!) or take the form of automated drip campaigns that lack personalization or substance. Instead, organizations can be customer-centric while also illustrating the many ways they provide value time and time again.

For instance, let’s say you sell digital wayfinding products like mall directories or train station touchscreens to property developers and transit agencies. You could send a weekly or monthly email to them with the number of travelers or visitors who used the products. Which shops or restaurants were most often searched? Which subway lines received the most clicks? That’s useful information that customers can fold into their business decisions, all thanks to your product.

Another approach involves educational content based on customers’ needs. Which pages in your customer service center or knowledge base do they visit most? What do they complain or rave about on social media? How might your organization solve their pain points? Develop articles, social posts, webinars, etc. that respond to what engages your audiences most and share it on the channels where they’re most active. You can even take it a step further and personalize the content based on customer behaviors or segments.

By consistently offering helpful versus promotional content, you’ll gain audiences’ trust. They’ll come to see your brand as a reliable, valuable resource, and should you raise prices in the future (another tactic guaranteed to boost AOV), you’ll have already presented a strong case for the increase. Just be sure to alert customers of any price changes well ahead of time, especially if you’re a B2B organization and your customers’ budgets require departmental approval.

5. Expand revenue through up- and cross-sells

Creating and distributing good content doesn’t mean you can’t also hawk your goods and services; you just have to be judicious about how and when you do so. Remember how existing customers are more receptive to additional purchases? That’s your green light for up- and cross-sells.

Keep in mind that the two tactics differ. Upselling involves upgrading customers to a comparable higher-end product than the one they’re already buying — for example, convincing a customer to purchase a more expensive television or computer than the one they were originally contemplating.

Upselling is worth a try. E-commerce businesses, for instance, generate 10% to 30% in revenue from upsells.

In contrast, cross-selling involves the sale of similar or complementary products or services. Once again, Amazon is a great example of a business that’s got it down pat. Each of its product pages feature recommendations for similar (“You might also like”) and complementary (“Frequently bought together”) items.

Other companies try bundling various products and services and selling them at a price lower than what they would have cost if bought separately. Or they add a sticky sidebar that scrolls along with users browsing their e-commerce website and highlights popular products or sale items. Experiment to find the tactics that work best for you.

6. Establish a loyalty or rewards program

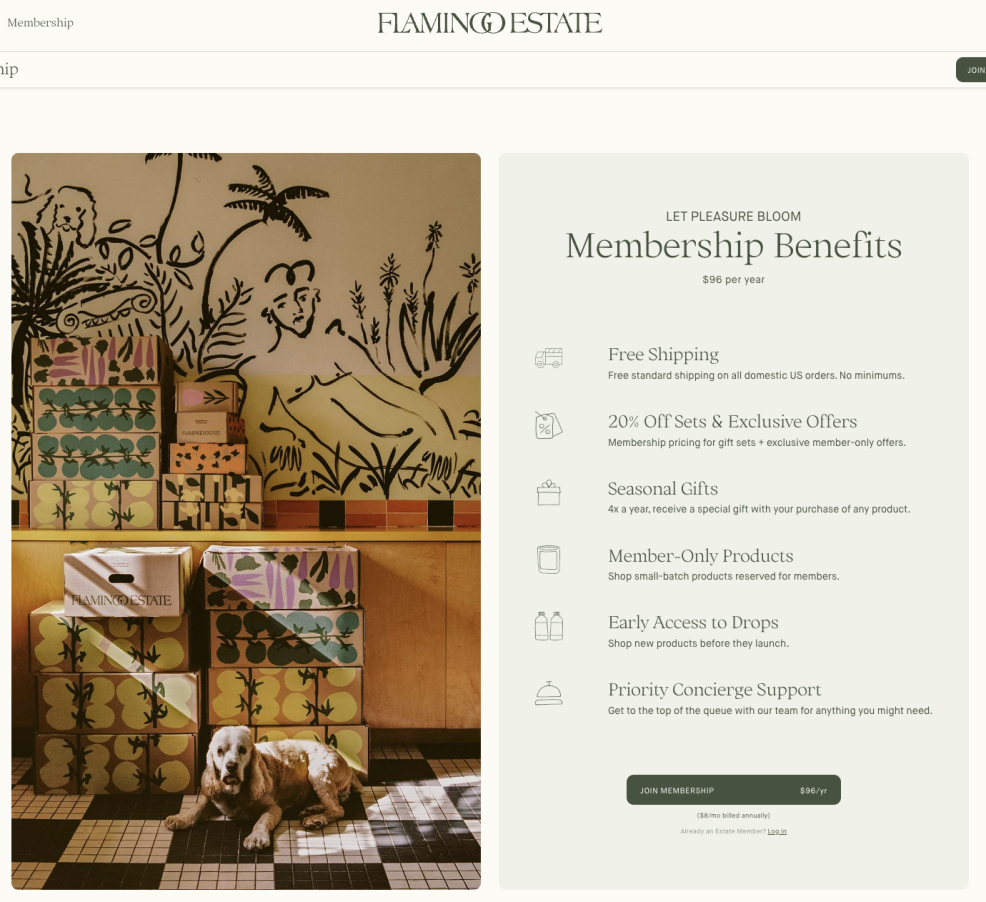

Cement your relationship with long-time customers by establishing a loyalty program that may also attract new-to-you audiences seduced by the program’s perks. Examples include exclusive access to members-only content, skipping to the front of the line at events, free shipping, and so on. Customers could pay an annual subscription to join the program, like you find with Flamingo Estate, or it could be free, with members earning rewards for repeat business, like the Madewell Insider program.

You could also consider mining your customer data to identify high-ticket buyers for the last year (or other time period). Then, reach out to that cohort and surprise them with a gift or other offer as a thank-you for their business. It’s a chance to make them feel special and to nurture an important relationship.

7. Provide unparalleled customer service

Depending on which reports you look at, poor customer service costs businesses anywhere between $75 billion to $1.6 trillion per year. If that’s not enough to raise concerns, there are a whole host of statistics that should ring alarm bells: how unhappy customers tell twice as many people about their negative customer service experience than those who have positive experiences, how 37% of consumers abandon their carts or post a bad review after a poor digital shopping experience, and so on.

Avoiding such outcomes means investing in your customer service offerings. Do you provide omnichannel support, for instance? Consumers jump from one device to another and from one channel to another; be nimble enough to move with them, even if it means ensuring live chat support at 3 a.m. Globalization means customers can be in any time zone, so offering 24/7 support can be an important selling point.

Ideally, you know which channels your customers use most and can allocate resources to those if staffing is a challenge. If social media is a critical channel for your audiences, for example, be sure you have a team monitoring it. 76% of consumers expect brands to respond on social media within 24 hours, reports Sprout Social. Don’t give them a reason to broadcast further grievances with your brand.

Don’t forget about developing self-service tools like a knowledge base, either. While it takes time to create one, it will free up your support team and empower customers to troubleshoot issues on their own.

Why is customer lifetime value so important?

We’ve established the significance of CLTV to profit margins, but there are additional nuances to keep in mind.

For example, we reviewed the headaches of calculating CLTV, but how do you evaluate whether yours is robust or anemic? A simple rule of thumb: Your CLTV should be at least three times higher than your customer acquisition cost (CAC). From marketing costs to customer service overhead, CLTV needs to be high enough to cover all costs associated with a customer. If your CAC is $100, for instance, your CLTV should be at least $300. Lower than that and you’ll face challenges scaling the business. Margins will be slight, and one bad month could start a slide that’s hard to stop.

So, compare your CLTV with industry averages to gauge its health and see what it says about your retention strategy. If it’s been forcing you to constantly acquire new customers to maintain revenue, then it needs retooling. Chasing acquisitions means high ad spend, lower ROI, and increased vulnerability to market forces. Better to ensure a loyal customer base that’ll stick with you through the hard times.

The bottom line

No doubt about it: Customer lifetime value is a key metric for successful organizations today. It grows revenue and helps finance teams better plan budgets. If your organization operates on subscriptions, for example, encouraging existing customers to switch from a monthly to a yearly billing cycle raises your AOV and gives accounting teams a more stable budget to work with.

Naturally, you’ll more easily raise your CLTV if you have the right tools in place. There are a number to explore, such as hybrid or headless content management systems (CMSs) that allow organizations to reach customers with the right content at the right time in the right channel. There are also digital experience platforms (DXP) that facilitate strong customer connections and the delivery of delightful digital experiences in our always-on world. And don’t forget the CDPs that we mentioned earlier. They’re a critical component to understanding who your customers are across multiple data silos and allow you to communicate with them in a personalized and meaningful way.

Acquia offers many of these tools and has been recognized as an industry leader in numerous reports, such as the 2024 Gartner® Magic Quadrant™ Report for DXP. To learn more about the tools and platforms we offer, choose the method that suits you best: chat with a representative, watch a demo, or click your way through a product demo.