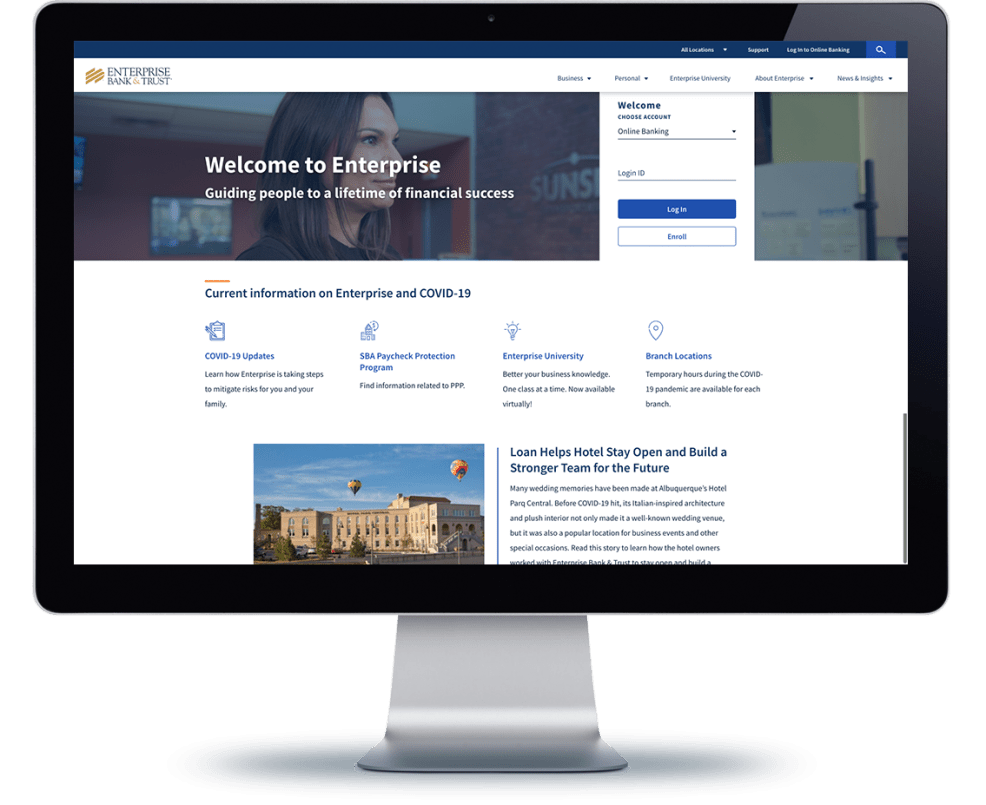

Enterprise Bank & Trust

Drupal, Acquia Cloud Platform, Acquia Edge Security

YoY increase in contact form submissions

number of MQLs sent to sales

The Client

For more than 30 years, Enterprise Bank & Trust has served the lifetime financial needs of privately-held businesses, their owner families and other success-minded individuals. The company is headquartered in Clayton, Missouri and operates branch locations in Arizona, Kansas, Missouri, and New Mexico.

The Situation

With new banking customers and risk advancement in the industry, Enterprise Bank & Trust realized it needed to transform the way the company approached marketing and customer experience. Its marketing team knew they needed to collect more data to better understand and meet the needs of their varied audiences. With the appropriate data, Enterprise would be able to provide a more personalized experience, giving their banking customers in different states content that was relevant and met specific regulatory issues.

The Challenge

When Enterprise Bank & Trust began the initiative to transform its sales and marketing approach, marketing was not seen as part of the revenue engine. Additionally, established siloes made it difficult for marketing and sales to align and collaborate. Change management would be necessary to drive the initiative internally and get buy-in from members at all levels of the company so that the company’s digital transformation could be completed.

The Solution

Working together with Bounteous, Enterprise Bank & Trust developed personas and mapped the sales process to the buyer journey prior to building the new Drupal website from the ground up.

The website rebrand, focused on customer journey management, aligned touchpoints with audience calls-to-action, significantly reducing friction and increasing revenue and loyalty.

By following a four-step customer journey maturity model, Enterprise Bank & Trust and Bounteous were able to focus on specific areas, set manageable goals, and put to work tools and tactics to improve across each discipline.

The Results

Enterprise Bank & Trust has revolutionized the financial services space by launching a new website experience featuring personalized content, updated product information, and access to online banking, as well as the ability to capture and measure interactions along with an integrated CRM system. In just the first year of implementation, the new site has seen more mobile users than ever before. Additionally:

- New users are up 97% from 2018 to 2019

- Contact form submissions increased by 26% from 2018 to 2019

- The number of MQLs sent to sales has doubled year-over-year